One Mount Group, Vietnam's largest technological ecosystem, creates solutions to serve retail, distribution, real estate, and financial services, including ONEU, a premier lifestyle platform that provides access to essential services. Trusted by millions of users, One Mount Group uses Ververica's Unified Streaming Data Platform to enhance operational efficiency and standardize their streaming application management. By delivering Apache Flink® as a Platform-as-a-Service offering to its internal development teams, ONEU optimizes the deployment and management of Flink applications, ultimately supporting real-time fraud detection for millions of financial transactions daily.

“Ververica's Unified Streaming Data Platform allows us to create a Platform-as-a-Service offering for Apache Flink to our internal teams, significantly improving our development practices... The unique feature set and Flink SQL support are essential to stream processing systems like ours. Ververica Platform: Self Managed saves us a lot of time by making it easier to turn Flink into a Platform-as-a-Service within the organization.”

-Quan Phyong, Head of System Platform, One Mount Group

Fraud Detection

Prevent loss with real-time intelligent data and predictive responses.

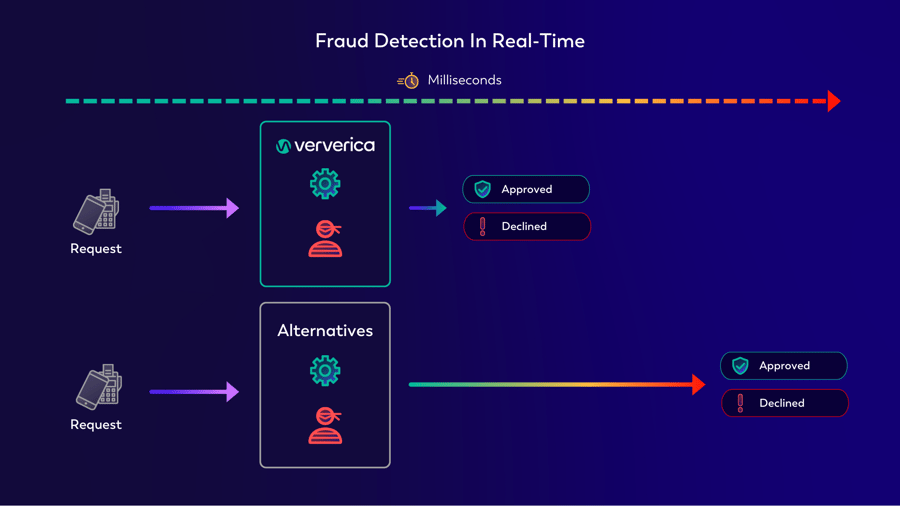

Combat fraud and stay ahead of growing threats with millisecond anomaly detection.

Brands you know trust Ververica

Can You Catch a Fraudster?

With centralized data coordination and deep analysis across your data-rich systems, Ververica’s Unified Streaming Data Platform safeguards your business and customers like never before.

Rapidly respond to the ever-increasing speed of new attacks and the continuous evolution of the threat landscape, with a highly adaptable real-time fraud detection solution that allows instant change so you're ready to catch anomalies before they occur.

Business Challenges

Fraud detection saves money, protects identities, and builds customer trust and satisfaction while reducing the time and resources your team spends preventing attacks. But fraudsters can be hard to identify, as they try their best to hide their activity within vast amounts of data.

Challenge

Solution

Fraudsters constantly adapt, evolve, and innovate their methods.

Real-time streaming allows you to detect, mitigate, and stop suspicious activity in its tracks.

False positives flag legitimate transactions as fraudulent.

Reduce operational inefficiencies and eliminate unnecessary investigation time with fully integrated, real-time data flows.

The sheer volume and speed of data generated makes it challenging to process and analyze for potential fraud without compromising performance or user experience.

Ververica offers elastic scalability that ensures relatable and cost-effective processing regardless of workload.

Fraud detection relies on data points that lack context, making it hard to differentiate between legitimate and fraudulent activities.

Get historical data integration and enrichment that adds context and improves speed, guaranteeing precise, accurate fraud detection.

Overly strict fraud detection mechanisms add friction to legitimate transactions and can harm customer experiences.

With Ververica, speed, data freshness, pattern recognition, and historical context combine to ensure an optimal customer experience.

Poor quality data or incomplete data sets can undermine the effectiveness of fraud detection systems.

Ververica delivers accurate, comprehensive, and consistent data with real-time, event-driven updates.

Successful fraud detection often requires significant technological investments and resources.

With Ververica, you'll have the technical support and expertise to remove resource limitations and boost developer efficiency.

Modern fraud response relies on advanced machine learning and AI models for pattern identification and anomaly detection.

Take advantage of an enterprise grade real-time stack, including support for predictive analytics and machine learning pipeline integrations that continuously refine your AI/ML models and rulesets.

As bots proliferate online environments and bad actors emerge internally, businesses face growing challenges detecting and preventing fraudulent activities and misconduct in an automated, proactive manner.

Ververica supports advanced technology, data-driven strategies, and expertise balancing security with employee and customer experience.

Fraudsters only need to be successful once, while defenders must catch every malicious attempt.

Ververica processes vast amounts of data in milliseconds, identifying known attack patterns and challenging suspicious activity as soon as it is detected, ensuring no matter the volume of attempts, bad actors fail every time.

Why Ververica?

Detecting and preventing fraud before it happens requires advanced systems capable of analyzing complex patterns quickly. Achieving this while maintaining system performance adds to the technical challenge.

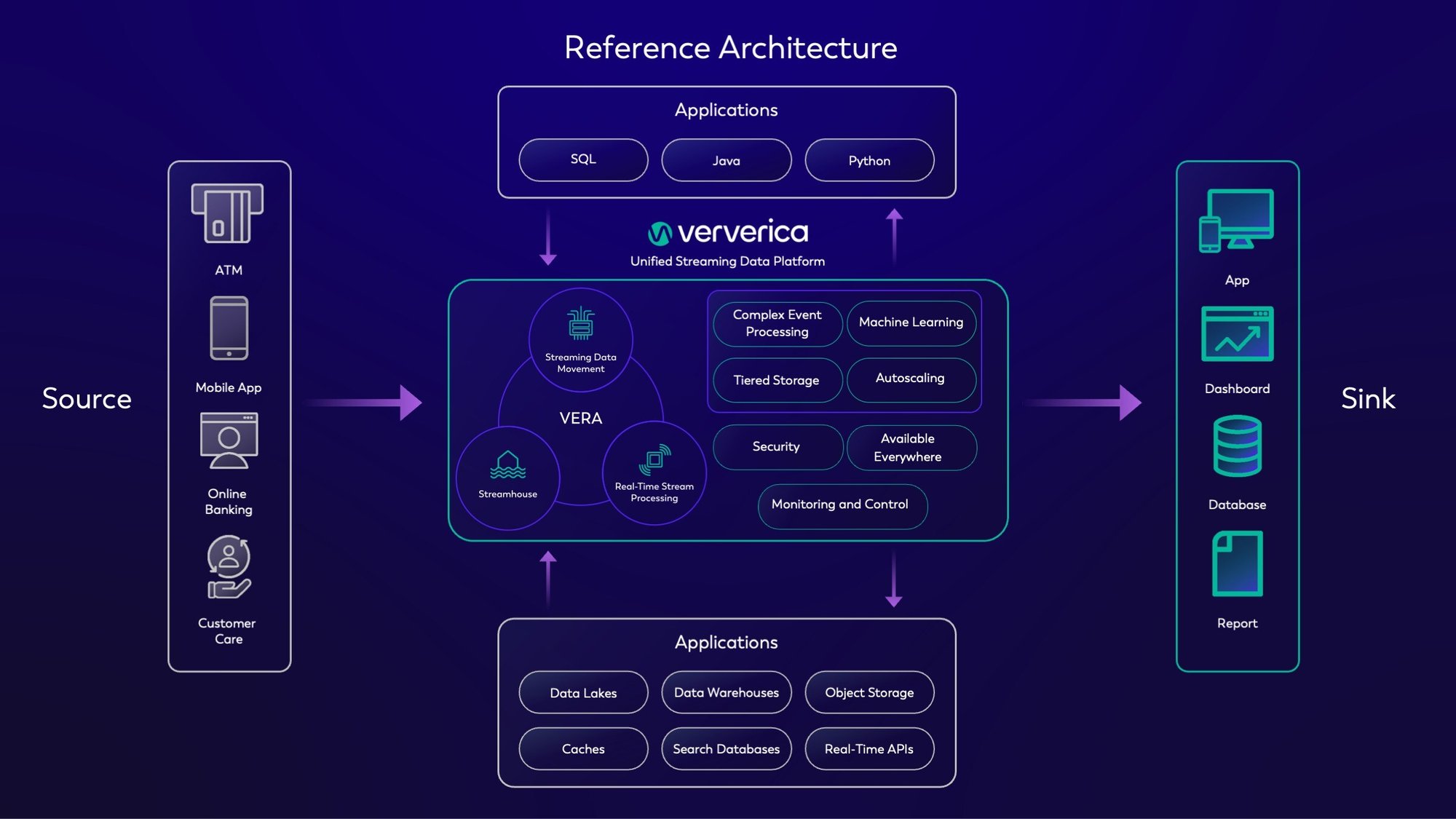

Ververica's Unified Streaming Data Platform integrates online and offline data sources to build a complete, cohesive real-time fraud detection system. Using cutting-edge event streaming and analytics, you can spot and stop fraud in milliseconds, before it harms your business.

Features of Ververica’s Unified Streaming Data Platform

Powered by VERA

Armed with the powerful cloud-native engine revolutionizing Apache Flink®, harnessing insights and taking action on data at any volume and scale has never been easier.

Dynamic Complex Event Processing

Trigger notifications and alerts for potential fraudulent activity and behavior, with rulesets you can update in real time.

Data Lineage and Governance

Track data movement to ensure transparency, accuracy, and compliance with regulatory and policy requirements.

Adaptive Learning

Develop and train your rulesets and models with highly scalable real-time insights, that adapt to the current threat landscape.

Real-Time Data Enrichment

Enhance raw data with contextual information using SQL, UDFs (User-Defined Functions), or custom code, reducing false positives and empowering complex reactions.

AI/ML Built-In

Analyze data instantly with advanced algorithms that identify suspicious activity with greater precision and adapt based on real-time feedback.

Top Benefits of Building Fraud Detection with Ververica

Millisecond Detection

Stop fraud before it happens. Detect anomalies and suspicious behavior the instant they emerge, preventing potential losses and safeguarding your assets with real-time monitoring.

Build Trust

Losing customer trust can be as costly as fraud. Data aggregation and dynamic ruleset management protects the customer experience, ensuring you only turn away actual fraudsters, bots, and bad actors - not legitimate customers.

Reduce Risk

Fast and accurate real-time fraud detection minimizes financial losses by stopping fraudsters before their activities can escalate. Stop criminals in their tracks, protect assets, and minimize labor, all while maintaining brand reputation and customer trust.

Success Story

Using Fraud Detection

Fraud detection is especially critical for financial and insurance industries. It is also valuable in preventing other types of illegitimate activities that cause loss, including:

Credit card payments

Online purchases

Anti-money laundering

Rouge stock trades

Stock market manipulation

Identity theft

Online account registration

Insurance claims

Anomaly detection

Employee onboarding

New profile set-up processes

Telecommunications

Online gambling

Shared economy

Peer-to-peer transactions

Digital wallets

Fraud Detection Reference Architecture

See how Ververica's real-time anomaly detection works:

Ready to safeguard your business?

Let’s talk

Ververica's Unified Streaming Data Platform helps organizations to create more value from their data, faster than ever. Generally, our customers are up and running in days and immediately start to see positive impact.

Once you submit this form, we will get in touch with you and arrange a follow-up call to demonstrate how our Platform can solve your particular use case.